The decision to create a catalog of the revenue stamps of Bangladesh came after many years of toying with the idea. I would find the stamps offered on the internet auctions and it was obvious that the seller knew nothing about them. A typical lot would have no description, other than “revenue stamps from Bangladesh”, and the group would include mint, used, and stamps on pieces of documents. I was also intrigued by the absurdity of some of the items. A document with over 200 stamps on it, or 50, or 150. It reminded me of the SERVICE overprinted stamps where they never had any high denominations and the envelope backs, and often the fronts as well, would be covered with low denomination stamps. I have come to learn that due to the problem of forged revenue stamps being made, the denominations were kept low. That explains whey so many are on some of the documents.

Surprisingly, throughout all those years I was dissuaded to attempt a catalog by one hundred percent of the people I mentioned it to. The standard arguments were that no one collected them, no one knew anything about them, they are too complicated to understand and, “it was too late” as no one had any information.

John Barefoot, Ltd, of Great Britain had included about ten pages of Bangladesh revenues in his British Commonwealth Revenues catalog and I had been given copies of the pages years ago. At the time I had no idea that they were from his catalog. The only other article I was familiar with was written by Joe Ross, a collector and researcher of revenue stamps. Joe is one of those individuals who takes on the impossible, pulls the information together and makes sense out of it for everyone else. His article was full of color illustrations and important information.

The Barefoot catalog pages I had had incomplete listings as I had stamps from series they listed that they did not include. Also, numerous stamps listed did not have the color indicated, only a question mark after them. At times the colors listed were incorrect. As incomplete as the catalog was, it was invaluable for sorting out the various categories of stamps. As of 2014 the catalog is in it’s ninth edition and recently had is second printing of the ninth edition.

You can be assured that the popularity of the catalog was not due to the inclusion of the Bangladesh revenues, but for many of the other countries.

With no catalog readily availabe for the revenue stamps of the country, virtually no one in Bangladesh collected them. Dealers did not handle them with any seriousness and when they stopped printing them, most of the handfull of collectors also stopped collecting.

While the handstamped Pakistani postage stamps had a cut off date for their usage, that apparantly did not happen with the revenue stamps and a combination of the Pakistani (Sometimes not overprinted Bangladesh) revenue stamps and the ones of Bangladesh can be found on the same document, often years after Bangladesh gained her independence. The above insurance policy was dated 20 January 1978.

My efforts will be posted on the internet free for anyone interested to view and I hope they can help me fill in those vacant spots that are throughout this initial effort. Fortunately on the internet new information can be added immediately and corrections made that are then the new record, until more information comes along.

Due to the flexibility of the internet it is possible to post images in color. Images are very important in determining what a stamp looks like, expecially when many are very similar in appearance. A difficult aspect of listing the stamps is the various colors. Often they are similar, with slight differences. Aditionally, the colors appear different as a result of the different scanners people use. That is very evident when seeing them on the auction house sites. I feel certain that the color descriptions of some of the listings in this catalog will be changed as time passes.

Often frustrating for “the purist” who will want to collect only the stamps of one issue on documents, is that the documents often have issues from several different series of that particular category, i.e. Insurance, Revenue, Special Adhesive, etc. on them.

A subject that I have never heard discussed is should one try to collect the entire document. Most collectors do not realize that often the pages covered with stamps, usually on both side, but not always, were separate sheets attached to the documents. Generally, they are sold separately, as collectors are interested in the stamps. The other pages without the stamps were often discarded and not saved by those dealing in the stamps. Since the focus is on the stamps, we often neglect the associated papers that might have been associated with the total document. It is my opinion that since we are collectors of revenue stamps, that is what our focus should be. If the entire document, with all the pages is offered, that is good, but if only the pages with the stamps on it are offered that is just as good. My position is that we are stamp collectors, not document collectors.

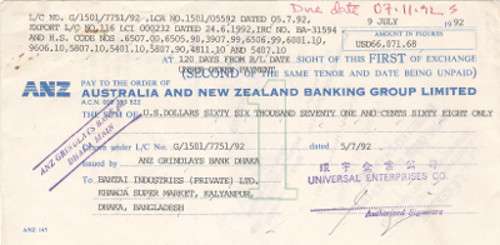

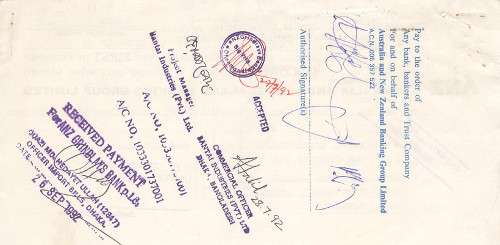

Above is an example of a full document. All of the pages were stapled together. The top images are both sides of the actual document that gives the information about the use of the stamps, dates, location, etc. The second page with fifty-one Tk.100 stamps on it was stapled to the above piece of paper. Below it was another smaller part of a page with seven Tk.10 yellow stamps and two Tk.1 green stamps on it. It was stapled to the page directly above it with the fifty-one stamps. Often only these separate pages are offered for sale. If they had not all been together no one would know they came from the same transaction. None of the pages with the stamps on them have any information about the transaction, except the name of the bank (In the canceling device). With the top page, we now understand much more about the usage of the stamps. Some of the court documents could be sixty or more pages long, with a stamp paper and perhaps a few stamps on one or two pages only. In this instance, since the total document contained only a few pages, it is a “bonus” item in a collection.

Remember that there is no “right” way to collect the revenues. They can be collected mint, used, multiples, or on documents. If you collect them on the original documents you will find that they are all different sizes, impossible at times to display in a album, the stamps are often inverted on the document, and/or placed over each other. You should try to get the best condition document for that issue that you can. Some of the stamps will only be found on stained, stapled, punched, or wrinkled documents. That unfortunately is the nature of the situation.

The best sources of this material in Bangladesh at the present time are the “junk” dealers who sell the documents by the kilo. They are essentially waste paper at that point and were thrown out by the respective insurance companies, etc.. The problem is that when you purchase a kilo you generally only find two or three different varieties of stamps in it. You will have to convince the seller to let you pick through them and then pay a higher price for the items you want.

A special thank you is due Mushfiqul Haque for sharing his stamp paper errors from his collection, Gholam Abed for his advice and information and to Arefin Khan who has been helpful in explaining the different uses of the stamps.

This effort is a “community” effort and relies on anyone and everyone with information on the stamps to make it a good reference tool. If you can provide scans of missing stamps, more information on any of the topics, or anything else to add to it, I would like to hear from you. I can be reached through Facebook (I don’t want to post my email as spammers find it and I get hundreds of SPAM every day).

R. Howard Courtney

Chicago, IL

August 2014

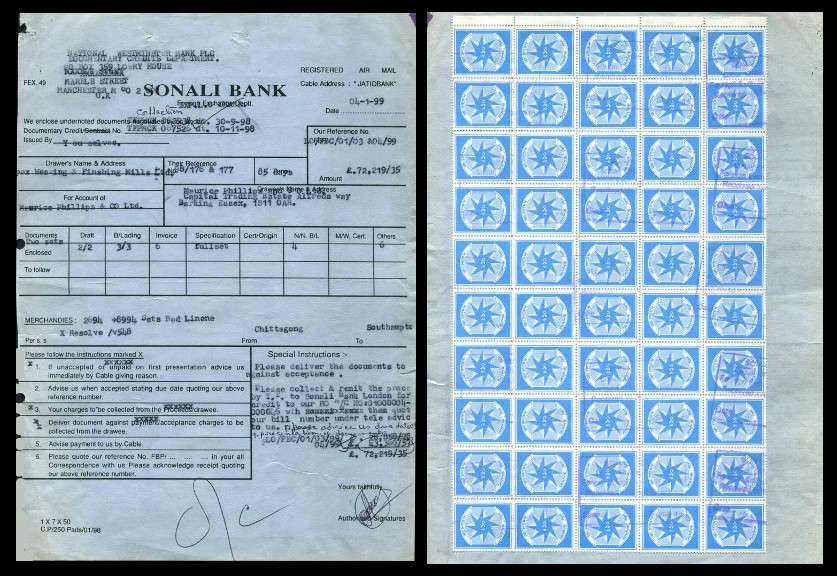

This document regarding business with England, dated 4 Januiary 1999 has 50 Tk.10 Foreign Bill stamps on the back of the document. They are all canceled with a rectangular handstamp, using a light magenta ink.

Additional Information regarding Stamp Papers and Revenue Stamps

Source: thedailystar.net

Source Date: Sunday, January 10, 2010

Focus: Public Institutions, Citizen Engagement

Country: Bangladesh

Created: Jan 11, 2010

The government will amend the Stamp Act 1899 in a bid to increase revenue collections from the sales of revenue stamp and stamp paper.

The amendment is also aimed at reducing hassles of the customers who often face problems because of a scarcity of stamp and stamp paper in the market.

A proposal in this regard was approved in an inter-ministerial meeting last week and now awaits approval from the law ministry.

In the proposed system, people will pay duty through bank draft (chalan) and pay order while making deals especially for company registration and transfer of shares in the stock market, said Nasiruddin Ahmed, chairman of the National Board of Revenue (NBR).

“This is another step we are taking to strengthen the revenue collection drive. If we can simplify the existing system, it will help enhance transparency of the system and encourage people to pay duties properly.”

“Now people often face difficulties while making important deals, mainly due to a scarcity of revenue stamp and stamp paper in the market. So we are trying to find alternative solutions to handle the issue and modernise the ‘Stamp Act 1899’,” he said.

In the new system, one can submit duties above Tk 300 in cash, and if the amount is more, one can pay through bank draft and pay order while making new deals, registering a new company or transferring shares, he said.

The modernisation will reduce cost of the government, remove anomalies in distribution and forgery of stamp papers and ease the bureaucratic load on sub-registry offices, said Ahmed.

He also said the government loses revenue from this sector due to circulation of counterfeit stamps every year.

Brokers often sell revenue paper and stamps at higher prices when there is a dearth in the market, the NBR chief said.

A revenue stamp, tax stamp or fiscal stamp is used to collect taxes or fees from registration of land and companies, tobacco, alcoholic drinks, medicines and firearms. These are some of the major sources of revenue income for the government.

At present, the government earns around Tk 5,000 crore from selling revenue stamp and stamp paper a year.